How Everyday Road Mishaps and ‘Third-Party’ Liability Shape Motor

Insurance Protection in India

It was a typical Monday morning in Chennai

when Priya set out to drop her brother at college. Traffic was building along

Anna Salai road, and the chill of the early winter air was punctuated by honks

and brakes. At a junction near the bus stop, a speeding two-wheeler skimmed the

rear of her compact hatchback. Thankfully, no one was seriously hurt. But when

the young rider lost balance and crashed into a parked scooter, the metal bent,

paint chipped, and tension rose.

Most of these reported incidents aren’t

dramatic collisions heard across media; many are the everyday fender-benders

that occur at junctions, in parking lots, or while changing lanes. Yet even

these minor accidents can trigger complicated legal and financial

ramifications, especially when they involve damage to someone else’s vehicle,

property, or person.

This is where one of the most important

parts of motor insurance comes into play—third party liability coverage.

Understanding Third-Party Damage and Why It Matters

In everyday urban traffic, whether it’s a

rider clipping a bumper in Bengaluru or a car knocking over a roadside vendor’s

stall in Delhi, it’s usually someone elsewho suffers the loss. Vehicles

involved, pedestrians hit, or property damaged due to a driver’s negligence are

all treated as third-party losses under insurance parlance.

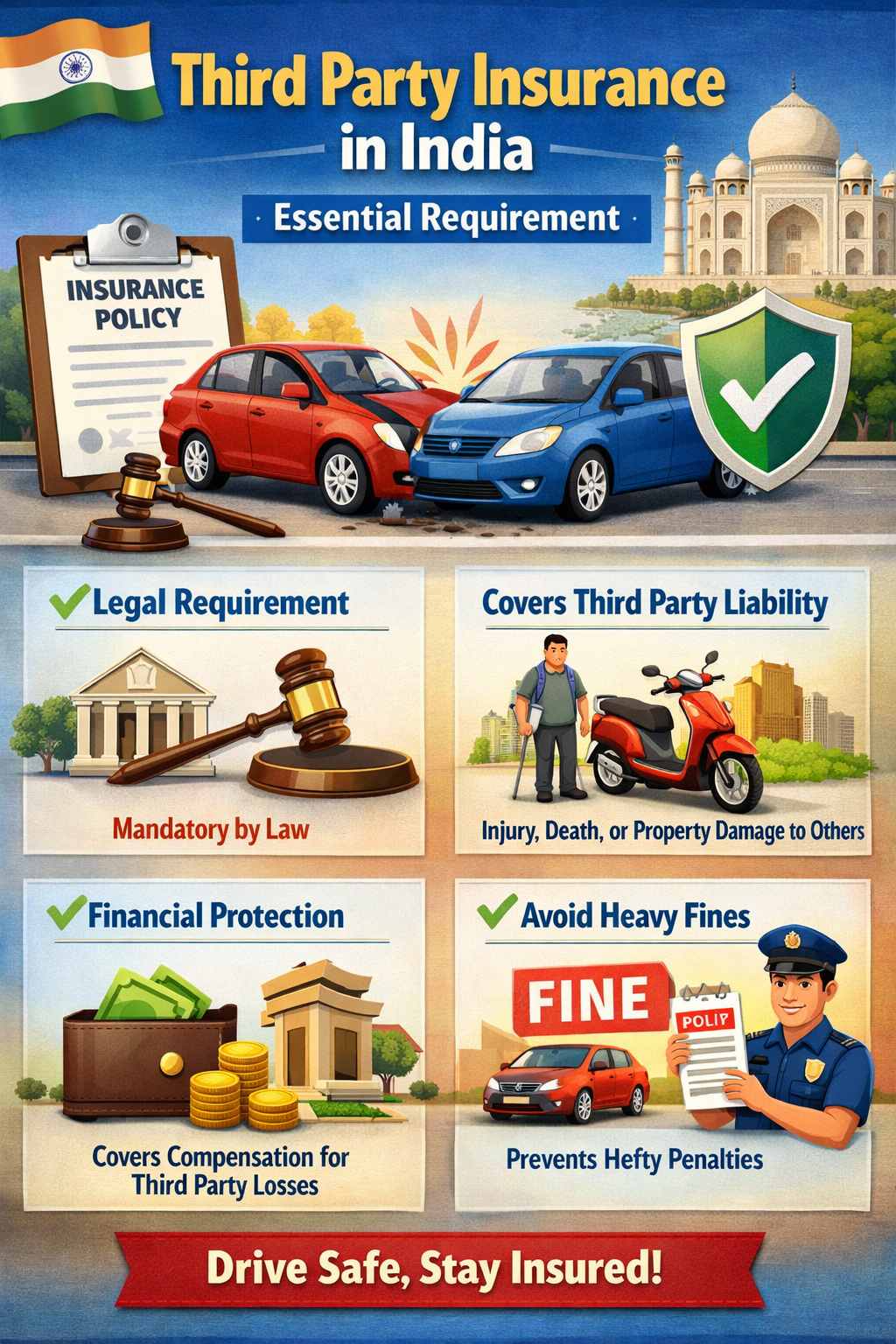

Legally, every vehicle plying Indian roads

must have third-party liability insurance. As per the Motor Vehicles Act,

1988, driving on public roads without valid third-party insurance is

not just risky, it’s unlawful. This compulsory cover safeguards you against the

legal liabilities that arise if your vehicle causes damage, injury, or death to

a third party.

Put simply:

l

First party= you (the insured

driver or owner)

l

Second party= your insurance

company

l

Third party= any person or

property affected by your vehicle in an accident

In Priya’s case, though her car was largely

unscathed from the initial bump, the scooter that was hit and dented belonged

to another commuter. The law requires compensation for such damage, and that’s

where third-party insurance kicks in.

What Third-Party Insurance Covers (and What It Doesn’t)

When a minor road accident causes damage to

someone else’s vehicle or injures another person, your third-party liability

policy covers:

l

Property damage: Repair costs for the third party’s car, scooter, or roadside

property damaged in the accident.

l

Bodily injury: Medical costs for injuries sustained by another person.

l

Death claims: Compensation if a third party tragically dies due to the accident.

However, it’s crucial to understand what

this policy doesn’t cover:

l

Damage to your own vehicle

l

Your own medical expenses

If Priya had only third-party insurance and

her own car suffered damage in the crash, her insurer wouldn’t cover her repair

bills. For that, she would need a comprehensive motor insurance policy, which

builds on third-party cover by including damage to your own vehicle too.

Comprehensive policies combine your repair

costs plus third-party liabilities in one package, a smart choice in India’s

dense traffic realities.

How Insurance Protects Drivers and Victims Alike

For a driver like Priya, having third-party

insurance meant she didn’t have to pay out of pocket for damage to the scooter

or any minor injury claims that might arise. Her insurer stepped in to settle

the liability in accordance with policy terms and statutory limits. This kind

of coverage:

l

Reduces legal exposure: Insurance handles compensation negotiations or payouts as required.

l

Ensures victims get relief

quickly: Third parties don’t need to wait for the

driver’s personal funds to cover medical or repair costs.

l

Provides peace of mind: Drivers can focus on safe driving without fearing financial ruin

over everyday misfortunes.

It’s this financial buffer that makes

third-party insurance such a vital tool in road safety policy—especially in a

country where daily traffic volumes are exploding, and minor mishaps are all

but inevitable.

Beyond the Crash: Legal and Practical Takeaways

Indian roads are a complex mix of vehicles,

pedestrians, cyclists, buses, and goods carriers. With around half a million

accidents recorded annually, the likelihood of encountering a minor collision

is real for most commuters.

For everyday drivers, three practical

lessons stand out:

1. Third-party insurance isn’t optional;

it’s the law. Driving without it can attract fines and penalties under the

Motor Vehicles Act.

2. Comprehensive insurance enhances

protection, including own damage, theft, fire, and natural peril coverage on

top of third-party liabilities.

3. Always report and document accidents, even

seemingly minor ones, before repairs or settlements, to ensure smooth claims.

As Priya reflected later, “It seemed like a

tiny bump at first, but without insurance, even small bills and legal worries

could have turned into a long fight.” That’s why understanding the layers of

motor insurance—from compulsory third-party cover to optional add-ons—is

essential for every Indian driver.

Conclusion: Everyday Roads, Everyday Protection

Road accidents don’t always make breaking

news. More often, they are the almost-routine incidents that happen at busy

intersections, stalled signals, or parking lots as we rush through our day.

These minor road accidentscan easily spiral into legal or financial hassles

without the right insurance cover.

Third-party liability insurance may seem

like just another box to tick, but it’s a legal necessity and financial shield that

ensures drivers and victims don’t end up in bitter disputes or costly battles

after a collision.

In a country with nearly half a million

accidents reported each year, and with many drivers still uninsured, adopting

and maintaining valid motor insurance isn’t just smart, it’s a responsible

habit that keeps India’s roads safer and its citizens more secure.