When purchasing insurance, the base policy often feels straightforward

until your agent or online checkout presents a dizzying array of optional

extras. Critical illness cover, personal accident benefits, waiver of premium,

hospital cash—the list of insurance

riders and add-ons can seem endless. Each promises additional

protection, but each also increases your premium.

The insurance industry's approach to add-on insurance mirrors retail tactics you'll

recognise from other purchases. Yet dismissing all riders as unnecessary would

be equally misguided. Some add-ons provide crucial protection for specific

circumstances, filling gaps that standard policies intentionally leave open.

The challenge isn't whether to purchase extra insurance cover universally, but rather

determining which additions align with your genuine needs, life circumstances,

and risk profile. A rider that's essential for one person might be redundant

for another, depending on existing coverage, family situation, occupation, and

financial resources.

This guide cuts through the confusion surrounding insurance riders and add-ons,

helping you evaluate which extras deserve your premium pounds and which you can

confidently skip.

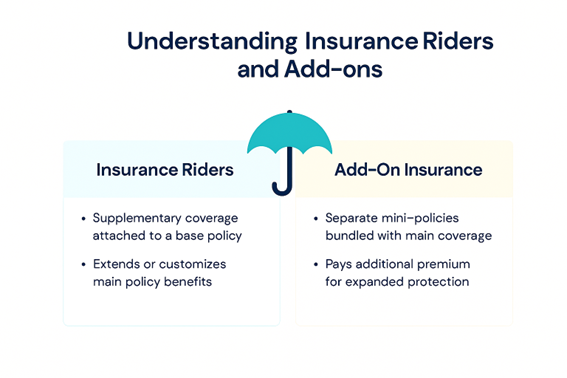

Understanding Insurance Riders and Add-ons

![]()

![]() Before evaluating specific options, clarity about

what these terms mean prevents confusion during purchase discussions.

Before evaluating specific options, clarity about

what these terms mean prevents confusion during purchase discussions.

Insurance riders are supplementary

benefits attached to your main policy, extending coverage beyond the base

contract's scope. They function as amendments or additions that customise

standard policies to your specific needs. Riders typically cannot exist

independently—they require an underlying base policy to attach to, much like

extensions require a main building.

Add-on insurance serves a similar

purpose but sometimes operates as separate mini-policies bundled with your main

coverage. The terminology varies between insurers and policy types, but the

principle remains consistent: paying additional premium for coverage beyond

standard policy terms.

The key distinction from standalone policies is integration. Rather

than managing multiple separate insurance contracts, riders consolidate various

protections under one policy umbrella, simplifying administration while often

costing less than equivalent standalone coverage.

The insurance market offers numerous riders, but certain categories

appear consistently across policy types. Understanding these helps frame

decisions about add-on policy

selection.

1.

Health-Related Riders

Critical illness cover pays lump sums upon diagnosis of specified

serious conditions. Hospital cash provides daily allowances during

hospitalisation. Surgical care riders cover operation costs. These address the

financial impact of health events beyond basic policy scope.

2.

Income Protection Extensions

Waiver of premium riders continue coverage without payment during

disability or unemployment. Accident benefits provide payouts for

injury-related disability. These protect your insurance itself when income

disruption threatens your ability to maintain premiums.

3.

Enhanced Benefit Riders

Accelerated benefit options allow early access to death benefits

during terminal illness. Return of premium features refund paid premiums if you

outlive term policies. Increased coverage riders guarantee future coverage

increases without fresh medical underwriting.

4.

Family Protection Add-ons

Spouse and child riders extend coverage to family members under your

policy. Education benefit riders ensure children's school fees continue despite

your death or disability. These address dependant protection comprehensively.

Not all riders provide equal value, and determining which deserve your

money requires systematic assessment rather than emotional reaction to

worst-case scenarios.

1.

Assess Existing Coverage First

Before adding any extra

insurance cover, audit what protection you already possess. Employer

benefits, credit card insurance, mortgage protection, and other existing

policies might duplicate proposed rider coverage. Paying twice for the same

protection wastes money regardless of how valuable that protection might be.

2.

Match Riders to Real Risks

Your personal circumstances determine which risks warrant additional

coverage. Young singles without dependants need different protection than

parents with mortgages and school fees. Evaluate riders against your actual

vulnerabilities rather than generic fear-based marketing.

3.

Consider Probability Versus Impact

Some risks are statistically unlikely but financially catastrophic if

they occur. Others happen frequently but cause manageable disruption. Rider coverage explained

through this lens—weighing likelihood against potential damage—provides clearer

purchase guidance than emotional appeals.

4.

Calculate Cumulative Costs

Individual rider premiums might seem modest, but accumulating multiple

add-ons substantially increases total policy costs. Project these costs across

your policy term to understand the true financial commitment. Sometimes, the

cumulative premium for numerous riders approaches standalone policy costs with

greater flexibility.

5.

Check Exclusions and Conditions

Rider benefits often contain more restrictions than base policies.

Survival periods for critical illness claims, elimination periods for

disability benefits, and specific definitions of qualifying events can limit

practical value. Understanding what's excluded prevents disappointed

expectations during claims.

![]() Image Suggestion:

Image Suggestion:

Title: Which Rider Is

Best: A Framework for Decision-Making

Replaceability Test

Can you afford the loss without insurance? If yes, self-insure. If not,

the rider is essential.

Availability Alternative Test

Is standalone coverage more flexible or affordable?

Life Stage Alignment Test

Does this rider match your current life stage and duration of need?

Opportunity Cost Test

Could the premium be better used for savings, debt, or investments?

![]() Rather than recommending specific riders

universally, applying decision frameworks helps identify what's appropriate for

your situation.

Rather than recommending specific riders

universally, applying decision frameworks helps identify what's appropriate for

your situation.

The Replaceability Test

Could you financially absorb the loss this rider protects against? If

yes, self-insuring through savings might prove more economical than ongoing

premiums. If no, the rider addresses genuine need rather than theoretical

concerns.

The Availability Alternative Test

Can you purchase equivalent standalone coverage more flexibly or affordably?

Some rider coverage comes at premium pricing compared to dedicated policies,

while other riders offer better value than standalone equivalents.

The Life Stage Alignment Test

Does this protection match your current life stage and likely duration

of need? Coverage for raising children matters during parenting years but

becomes less relevant as children reach independence. Timing your rider

coverage to actual need periods maximises value.

The Opportunity Cost Test

What else could you do with the rider premium? Sometimes redirecting money

toward emergency funds, debt reduction, or investments provides better overall

financial security than additional insurance coverage.

Despite the caution warranted when evaluating extras, certain

circumstances make add-on

policy selection straightforward.

Riders that cannot be added later without medical underwriting deserve

serious consideration at policy inception. Health changes might make future

additions impossible or prohibitively expensive, meaning declining coverage

today eliminates future options entirely. This applies particularly to critical

illness riders and enhanced benefit options tied to health status.

Coverage addressing gaps in standard policies often justifies

additional premium. If base policies explicitly exclude scenarios relevant to

your situation, appropriately targeted riders fill genuine protection holes

rather than duplicating existing coverage.

Bundled discounts sometimes make adding riders economical compared to

standalone alternatives. When insurers offer multiple riders at reduced

combined premiums, the package might deliver better value than cherry-picking

individual coverages separately.

Equally important as knowing when to buy is recognising when to

decline, saving premium for more productive financial purposes.

Overlapping coverage wastes money regardless of how good the

individual protections might be. If existing policies already address the risks

a proposed rider covers, additional layers provide no incremental benefit worth

the cost.

Low-value, high-frequency scenarios often represent poor insurance

targets. Situations you could reasonably handle from savings or routine

budgeting don't warrant insurance premiums that, over time, exceed likely claim

amounts. Insurance works best for high-impact, lower-frequency events.

Marketing-driven rather than need-driven extras deserve scepticism. If

you cannot articulate a specific personal scenario where a rider would prove

essential, you're probably responding to sales pressure rather than genuine

protection requirements.

Evaluating insurance

riders and add-ons ultimately requires balancing comprehensive

protection against budgetary realities and the opportunity cost of premium

expenditure.

Start by identifying your genuine vulnerabilities—the financial

disasters that would devastate your family or derail your life plans. Match

available riders to these specific concerns rather than accumulating coverage

for every theoretical possibility. Prioritise riders addressing your

highest-impact risks within your budget constraints.

Remember that insurance serves to transfer risks you cannot afford to

self-insure. Extra insurance

cover makes sense when it addresses genuine gaps in protection for

scenarios beyond your financial capacity to absorb. It becomes wasteful when it

duplicates existing coverage or insures manageable disruptions better handled

through ordinary budgeting.

The decision whether to pay extra for insurance riders isn't about whether add-ons have

value—many do. It's about whether specific riders address your particular

circumstances sufficiently to justify diverting premium from alternative uses.

By systematically evaluating optional

cover benefits against your real needs, existing protection, and

financial priorities, you transform this complex decision into a manageable

assessment that serves your interests rather than simply generating insurer

revenue.